Thoughtful people who are long-term investors must first decide on their investment objectives when deciding between active or passive managed funds.

Investing in equities is an increasingly popular method of assisting people to achieve their long-term financial goals. An investment in equities can generate promising returns over time as companies grow and become more profitable.

Further, dividends paid by listed companies also provide a good income stream for investors. In Australia the benefit of franking credits enhance the attractiveness of equities as an asset class.

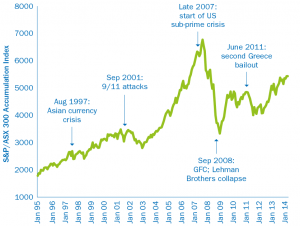

However, there are also risks associated with investing in shares. Companies that struggle are likely to see their share prices fall and stock markets as a whole can be affected by periods of economic weakness or unexpected events, as illustrated by the chart on the next page.

In order to minimise risk many investors maintain exposure to shares in professionally managed funds. These funds are usually well diversified, spreading investment risk across a wide range of companies. There are two distinct types of funds that are available to investors – active funds and passive funds. In this paper, we will take a closer look at both types of funds and highlight the key differences between the two.

What is active investing?

Most actively managed funds aim to outperform a particular index, for example the S&P/ASX 300 Accumulation Index (ASX 300).

To achieve this, the fund managers actively research companies that are constituents of the index. Professional managers typically have the resources required to complete detailed analysis on companies and skilled investors can identify those likely to perform better than the market average over time. These qualified investors have access to information, research and robust investment processes that are not readily available to individuals.

Following this analysis, active fund managers buy and sell shares in an effort to maximise returns for investors. They will buy stocks that are expected to perform better than the broader market, sell winning stocks following a period of favourable performance, and avoid those that are expected to underperform.

The intention is that the combined portfolio of shares will perform better than a comparable index, normally referred to as the ‘benchmark’. Of course there is also a risk that active funds will perform less well than the benchmark index if the selected stocks do not perform as well as the manager anticipates.

The performance of active managers is typically measured against these benchmark indices, which they try to outperform by a given margin. The extent to which returns vary from those of the benchmark index is a fair indication of the manager’s skill.

Chart 1: Volatility in sharemarkets is constant

Source: Colonial First State. S&P/ASX 300 Accumulation Index Jan 1995 – May 2014. Chart is for illustrative purposes only.

What is passive investing?

A passive investment manager tries to replicate a sharemarket index, such as the ASX 300, by owning shares in each constituent of the index. The quantity of each stock held is determined by the stock’s weight in the index. If BHP Billiton accounts for 8.6% of the ASX 300, for example, a passive fund manager will invest 8.6% of the fund’s assets in that stock, and so on, for every stock in the index. The investor should expect returns to be close to that of the market index.

Which type of fund is right for you?

In deciding on the style of investment, investors must first decide on their investment objectives, in particular return targets. Most investors would expect to generate returns that are above that of a market index and would prefer investing in an actively managed fund. In this case, the selection of the active manager is crucially important and the consideration for investors is their confidence in an active manager to achieve their investment objectives. While past performance is not necessarily an indication of future performance, most investors will consider a manager’s long-term performance track record before making an investment.

Cost is another differentiator of the two styles. Actively managed funds typically charge a higher management fee to cover research costs and to pay for the large teams of experienced analysts that are typically employed in the management of the fund. In contrast, because no attempt is made to outperform a benchmark index through research or stock selection, management fees for passive funds tend to be much lower than for actively managed funds. Cost should not be the main factor in picking a fund as contrary to the belief of many investors, selecting an active fund based solely on a low fee can be a mistake.

Here is a summary of some of the key advantages and disadvantages of active and passive funds:

| Management style | Advantages | Disadvantages |

| Active | · Opportunity for the fund manager to research and select stocks that are expected to outperform the market average over time

· Potential to outperform a benchmark index and maximise returns for investors |

· Potential to underperform the benchmark if the selected stocks do not perform as well as expected

· Higher fees |

| Passive | · Very low risk of the fund underperforming a benchmark index by more than cost of fees

· Lower fees |

· No opportunity for fund managers to actively select stocks that are expected to outperform

· Typically unable to outperform a benchmark index |

One approach is not necessarily better than the other. Before making an investment, it’s always best to speak to a financial adviser, who can help you select a fund – whether active or passive – that can help you achieve your investment goals.