BlueRocke/SME Funding Hub Monthly Client Newsletter – November 2024

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: https://bluerocke.com/wp-content/uploads/2024/11/SMEBlueRocke-Newsletter-Nov-24.pdf

Read more

BlueRocke/SME Funding Hub Monthly Client Newsletter – October 2024

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: SMEBlueRocke Newsletter – Oct 24

Read more

BlueRocke/SME Funding Hub Monthly Client Newsletter – September 2024

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: SMEBlueRocke Newsletter – Sep 24

Read more

BlueRocke/SME Funding Hub Monthly Client Newsletter – August 2024

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: https://bluerocke.com/wp-content/uploads/2024/08/SMEBlueRocke-Newsletter-Aug-24.pdf

Read more

BlueRocke/SME Funding Hub Monthly Client Newsletter – July 2024

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: SMEBlueRocke Newsletter – July 24

Read more

SME Funding Hub & BlueRocke Monthly Client Newsletter – June 2024

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: https://bluerocke.com/wp-content/uploads/2024/06/SMEBlueRocke-Newsletter-June-24.pdf

Read more

BlueRocke Monthly Client Newsletter – May 2024

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: SMEBlueRocke Newsletter – May 24

Read more

BlueRocke Monthly Client Newsletter – April 2024

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: https://bluerocke.com/wp-content/uploads/2024/04/SMEBlueRocke-Newsletter-Apr-24.pdf

Read more

The types of fraud catching out Australians

A growing number of Australians are falling victim to fraud each year as the techniques employed by cybercriminals become increasingly refined. Understanding common types of fraud, and how to protect yourself from them, is important as their methods be …

Read more

BlueRocke Monthly Client Newsletter – March 2024

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: https://bluerocke.com/wp-content/uploads/2024/03/SMEBlueRocke-Newsletter-Mar-24.pdf

Read more

BlueRocke Monthly Client Newsletter – February 2024

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: https://bluerocke.com/wp-content/uploads/2024/02/SMEBlueRocke-Newsletter-Feb-24.pdf

Read more

BlueRocke Monthly Client Newsletter – January 2024

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: https://bluerocke.com/wp-content/uploads/2024/01/SMEBlueRocke-Newsletter-Jan-24.pdf

Read more

BlueRocke Monthly Client Newsletter – December 2023

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: https://bluerocke.com/wp-content/uploads/2023/12/SMEBlueRocke-Newsletter-Dec-23.pdf

Read more

BlueRocke Monthly Client Newsletter – November 2023

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: https://bluerocke.com/wp-content/uploads/2023/11/SMEBlueRocke-Newsletter-Nov-23.pdf

Read more

BlueRocke Monthly Client Newsletter – October 2023

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: https://bluerocke.com/wp-content/uploads/2023/10/SMEBlueRocke-Newsletter-Oct-23.pdf

Read more

BlueRocke Monthly Client Newsletter – September 2023

Click here to read the monthly eNewsletter exclusive for BlueRocke & SME Funding Hub clients: https://bluerocke.com/wp-content/uploads/2023/09/SMEBlueRocke-Newsletter-Sep-23.pdf

Read more

BlueRocke Monthly Client Newsletter – August 2023

Click here to read the monthly eNewsletter exclusive for BlueRocke clients: https://bluerocke.com/wp-content/uploads/2023/08/BlueRocke-August-2023-Newsletter.pdf

Read more

BlueRocke Monthly Client Newsletter – July 2023

Click here to read the monthly eNewsletter exclusive for BlueRocke clients: https://bluerocke.com/wp-content/uploads/2023/07/BlueRocke-July-Newsletter.pdf

Read more

BlueRocke Monthly Client Newsletter – June

Click here to read the monthly eNewsletter exclusive for BlueRocke clients: https://bluerocke.com/wp-content/uploads/2023/06/BlueRocke-June-Newsletter.pdf

Read more

BlueRocke Monthly Client Newsletter – May

Click here to read the monthly eNewsletter exclusive for BlueRocke clients: https://bluerocke.com/wp-content/uploads/2023/05/BlueRocke-May-Newsletter.pdf

Read more

BlueRocke Monthly Client Newsletter – April

Click here to read the monthly eNewsletter exclusive for BlueRocke clients: https://bluerocke.com/wp-content/uploads/2023/04/BlueRocke-April-Newsletter.pdf

Read more

BlueRocke Monthly Client Newsletter – March 2023

Click here to read the monthly eNewsletter exclusive for BlueRocke clients: https://bluerocke.com/wp-content/uploads/2023/03/BlueRocke-March-Newsletter.pdf

Read more

BlueRocke Monthly Client Newsletter – February 2023

Click here to read the monthly eNewsletter exclusive for BlueRocke clients: BlueRocke February Newsletter

Read more

BlueRocke Monthly Client Newsletter – January 2023

Click here to read the monthly eNewsletter exclusive for BlueRocke clients: BlueRocke January Newsletter

Read more

BlueRocke Monthly Client eNews – December 2022

Click here to read the monthly eNewsletter exclusive for BlueRocke clients: BlueRocke December Newsletter

Read more

BlueRocke Monthly Client eNews

Click here to read the monthly eNewsletter exclusive for BlueRocke clients: BlueRocke Newsletter Nov 2022

Read more

How BlueRocke Assists Accountants & their Clients

Here at BlueRocke we work with Accountants to support new Australians in their wealth creation. Over the past 10 years we have assisted Peter Chan and Andrew Wong at P&A Connect Accountants and Advisors with many of their clients who are busy medi …

Read more

Why Has My Balance in My Diversified Fund Dropped?

Interest rates around the world have gone up recently. This has caused the value of fixed interest investments such as bonds to fall. The fall in the value of bonds can directly impact the value of your fund. To understand why your fund’s balance has d …

Read more

Negative Returns and the Quality of Fixed Interest Investments

You may wonder if negative returns mean that your investment has gone bad. Rising interest rates do not mean the quality of the fixed interest investment has changed, and it is normal for the interest rate cycle for the value of fixed interest investme …

Read more

When It’s Time to Get a Financial Adviser

Financial advice isn’t just for the wealthy or those close to retirement. You might consider working with a financial adviser if you are not confident in your financial decisions because you don’t have the time, knowledge, or capacity to explore …

Read more

Share Market Falls: The Causes and What to Consider

Headlines about falling markets can be worrying – particularly if you’re approaching retirement. Find out more about the recent causes and what to consider. After stellar rises in 2021, share markets lost some of their shine in January with steep falls …

Read more

Should you switch investments when markets fall?

During a market downturn, you might be tempted to switch your super away from riskier investments, like shares, and into safer ones. But is it better to switch or What you need to consider When it comes to investing and super, everyone has a different …

Read more

Hedging for Different Market Scenarios

Hedging for Different Market Scenarios A look at specific strategies, and their trade-offs, for diversifying equity risk. More investors are considering broadening their approach to diversifying equity risk to include strategies such as long duration b …

Read more

Prepare for Economic Changes with a Broader Allocation

Prepare for Economic Changes with a Broader Allocation Learn how a diversified portfolio can be prepared for a number of economic scenarios. A portfolio mix that combines both traditional and non-traditional asset classes – such as TIPS and commodities …

Read more

The Benefits of Staying Invested

The Benefits of Staying Invested Investors are more likely to reach their long-term goals if they remain invested and avoid short-term decisions that may take them off course. What this chart shows As this hypothetical example shows, investors may make …

Read more

Understanding Inflation

Understanding Inflation Inflation affects all aspects of the economy, from consumer spending, business investment and employment rates to government programs, tax policies, and interest rates. Understanding inflation is crucial to investing because inf …

Read more

Understanding the Risk/Reward Spectrum

Understanding the Risk/Reward Spectrum Learn how various investments offer incremental opportunities for potential returns while still mitigating market risks. In uncertain markets, investors may be holding larger than usual amounts of cash. Incrementa …

Read more

Investment Basics: Bonds

Investment Basics: Bonds Learn the basics of bonds, including the concept of price. The bond market is by far the largest securities market in the world, providing investors with virtually limitless investment options. Many investors are familiar with …

Read more

Investment Basics: Duration

Investment Basics: Duration Learn the basics of bonds, including the concept of duration. Duration, the most commonly used measure of bond risk, quantifies the effect of changes in interest rates on the price of a bond or bond portfolio. The longer the …

Read more

Investment Basics: Benchmarks

Investment Basics: Benchmarks Learn the basics of benchmarks, including the crucial role a benchmark serves in investing. There are many different fixed interest indexes that can be used as benchmarks for a fixed- interest portfolio. Choosing the right …

Read more

Moving into aged care

Key takeaways There are three types of aged care which range from the ability to live independently or in supplemented accommodation If your relative wants to apply for Government subsidies to move into an aged care, they must be assessed by a member o …

Read more

Superannuation: how does it work in Australia

Superannuation is money that you save during your working life to use as income when you retire. Like any other investment, the intent is to increase your super account balance, over the long term, while you’re still working. Once you’ve reached retire …

Read more

Why understanding your risk tolerance can help build greater confidence for retirement

By Ninda Hendy The content is produced by the Good Weekend in commercial partnership with MLC. When it comes to our nest egg, some of us are happy to simply rely on the wonders of compound interest to grow the balance. Others, meanwhile, leave it up to …

Read more

Video – 2022 Focus: Expanding the Opportunity Set

2022 Focus: Expanding the Opportunity Set With inflationary risks and less accommodative policies likely to increase volatility, PIMCO Group CIO Dan Ivascyn offers strategies that may hedge inflation, broaden the opportunity set and potentially earn st …

Read more

Podcast: Catch 2022: What’s in store for the year ahead

Chief investment officers and economists assess the policy dilemmas and big investment themes of 2022. In this 54 minutes podcast by Fidelity, Richard Edgar is joined by Steve Ellis, Global Chief Investment Officer for Fixed Income, Romain Boscher, Glo …

Read more

Fidelity’s CEO and CIO discuss the outlook for 2022

Fidelity International’s CEO Anne Richards and CIO Andrew McCaffery discuss the ‘Catch-2022’ policy paradox and the fifth industrial revolution arising from the need to get to net zero emissions. Hosted by Richard Edgar, Editor in Chief. Watch the 9 mi …

Read more

The superannuation puzzle piece you might not be thinking about

By Andrea Sophocleous When it comes to super, the accepted wisdom is that performance is the most important consideration. That means we often ignore another critical part of our superannuation. Most super funds include life insurance along with total …

Read more

Festive season closure dates

Dear All Our office will be closed from end of day on Wednesday 22 December 2021 and will re-open on Thursday 6 January 2022. From all of us here at BlueRocke Investment Advisors, we thank you for your support and we wish you and your families a safe a …

Read more

Back in business: How you can make the most of 2022

Pent-up consumer demand promises a strong economic return, which bodes well for small businesses hoping for a return to normalcy in 2022. But that doesn’t mean business as usual will see you succeed – use these tactics to give your business a lead over …

Read more

Transferring your wealth to the next generation

Key takeaways Start the conversation early so younger generations understand what they’re likely to inherit There are strategies that can help to ensure your wealth passes in a tax-efficient manner Testamentary trusts can be beneficial if you want your …

Read more

Working from home tax deductions: COVID-19

It’s hard to see the good in COVID-19. One of the few upsides is that you may be able to claim some tax back for the expenses incurred from running your make-shift home office. With lockdowns forcing many more people to work from home, the ATO has intr …

Read more

How to build wealth in your 30s

Key takeaways Investing with a long-term plan means you’re less likely to be affected by short-term market fluctuations Keeping track of your expenses versus income can help identify possible savings to pay off debt Adding more to your super on a regul …

Read more

6 financial moves to make in your 50s and 60s

Key takeaways: Once you understand the type of lifestyle you want in retirement, you can start implementing a plan Adding more to your super on a regular basis can help to increase your retirement savings An estate plan is important to ensure your weal …

Read more

5 ideas for generating passive income

‘Passive income’ – the term conjures up images of long days relaxing on a beach free of financial worries because your investments are generating enough for you to enjoy life without needing a job. Maybe the term ‘replacement income’ is more accurate a …

Read more

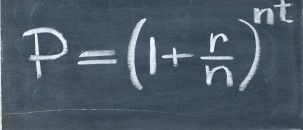

The power of compound interest

Albert Einstein is reputed to have said: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” As an investor, making your money work for you is the best way to increase your wealth. And the we …

Read more

What qualified advisers have over “finfluencers”

More people than ever are taking control of their money – but where do they go if they’re after financial advice? While ‘finfluencers’ are appealing to younger investors, ensuring any advice comes from a qualified adviser gives you a better chance of m …

Read more

What to consider when choosing a Life Insurance beneficiary?

When taking out a life insurance policy, it’s important to consider who should be your life insurance beneficiary and the role they play. What is a life insurance beneficiary? A life insurance beneficiary is the person who will receive your life insura …

Read more

‘Your Future, Your Super’ – what does it mean?

The Your Future, Your Super reforms (YFYS Reforms) were passed in June 2021. The YFYS Reforms aim to make the super system better for members in four key ways: Stapling – preventing the creation of multiple unintended super accounts; YourSuper – empowe …

Read more

How high-earning women can build their wealth.

More and more women are succeeding in high-paying careers. Here’s how to ensure today’s generous salary secures tomorrow’s future. While the gender wage gap remains largely stagnant – with the Workplace Gender Equality Agency reporting that women today …

Read more

Are super contributions tax deductible?

Key takeaways There are a whole range of strategies that make it worthwhile putting a little extra effort (and money) into your super Personal super contributions—those made from money you’ve already paid tax on such as savings or your take-home pay—ar …

Read more

Inflation: Friend or foe?

It might be unwise to extrapolate too much from this week’s inflation data on both sides of the Atlantic. This is peak bounce back. Like the surge in corporate earnings that we will see in the results season that started this week, the rise in inflatio …

Read more

2020-21 financial year in review

2020-21 was a remarkable year of economic and market recovery, but COVID-19 risks remain Despite the ongoing threat of COVID-19, massive fiscal and monetary support measures were successful in engineering an extraordinary global economic recovery. Shar …

Read more

Insurance – giving you peace of mind

If you’re a member of a super fund, it’s more than likely you have insurance through your super. The cost of this insurance is deducted from your super account balance – so you’re effectively paying for it – unless your employer is covering the cost on …

Read moreThe history of money and where it is headed.

Around 600 BC, the Chinese were among the first to invent money when they used coins worth the metal within to overcome the hassle of bartering. Around the first century AD, the Chinese invented paper and in the following centuries devised printing pre …

Read more

Key changes to super from 1 July 2021

Key takeaways Compulsory super contributions are legislated to increase from 9.5% to 10% as of 1 July 2021 Caps for your own super contributions will also increase, enabling you to add more to super The maximum amount of super that you can transfer int …

Read more

5 top investment truths

Many of us have probably received in our in-boxes spams for get-rich-quick-schemes with promises of making great amounts of money, effortlessly. If only getting rich was so easy. Rather than pipedreams being sold by spammers, here’s a list of 5 investm …

Read more

Why dividends make sense in an inflationary environment.

The fallout from Covid-19 put pressure on corporate dividend payments in many sectors and markets. Now, as economies recover and earnings bounce back, dividends worldwide are poised to rebound. At the same time, while widespread fiscal stimulus may pus …

Read more

Don’t forget about Estate Planning

“You only live twice. Once when you are born. And once when you look death in the face.” So said Ian Fleming, author of James Bond novels. It’s also a good way to think about estate planning. Many of us, naturally, put off thinking about our own mortal …

Read more

Interest rates – accentuating the negative

So it’s just a normal day. You walk into the bank, deposit some money. And the teller asks you to pay them interest. Keeping your cool, you ask why. And the teller apologetically explains: “Oh we’ve got negative interest rates.” Right now, we’re living …

Read more

2021 Federal Budget insights and analysis

On Tuesday 11 May 2021, the Australian Government handed down its Federal Budget. To understand what the Budget proposals mean – and how they might affect you personally, please find attached some resources prepared by MLC: Key initiatives summary whic …

Read more

Vanguard quarterly economic and market update – March quarter 2021

Stay on top of market and economic news with Vanguard latest quarterly analysis. Track the performance of Vanguard’s diversified strategies over the quarter, and get ahead of emerging themes and investment trends with expert analysis. Read the latest r …

Read more

The trend that will turbocharge emerging markets

Emerging markets are soaring off the back of the COVID-19 recovery, but there are a few consumer trends that are here to stay. One trend is a cut above the rest. Emerging markets have reached a point of discerning tastes and a hunt for quality. Consume …

Read more

Transferring your wealth to the next generation

Key takeaways Start the conversation early so younger generations understand what they’re likely to inherit There are strategies that can help to ensure your wealth passes in a tax-efficient manner Testamentary trusts can be beneficial if you want your …

Read more

How much do you need to retire?

Key takeaways Start with a clear idea about the type of retirement lifestyle you’re after Retirement calculators can tell you how much capital you need to support the lifestyle you want A financial adviser can guide you in implementing strategies to sa …

Read more

How to help your parents and still save for retirement

How to help your parents and still save for retirement The financial impact of COVID may have cut into your parents’ retirement savings, or perhaps they just simply didn’t save enough to last the distance. Whatever the reason, if you’ve now found yours …

Read more

Pros and cons of self-managed super funds

Having control over how your retirement savings are invested is one of the many benefits of self-managed super funds (SMSF). On the flip side, the responsibilities and management skills required to run an SMSF are significant. This is because you’re ac …

Read more

Bad Blood by John Carreyrou

Just read this superb book- one of those you can’t put down. Will be of interest to those into private equity funding for bio-medics. This true story is about developing a device, to have a blood test without using a syringe. What is asto …

Read more

What’s ahead for China’s markets in the Year of the Ox

Investors keen to see whether China’s bull market can keep charging ahead in the lunar Year of the Ox will be focused on the sustainability of economic recovery and the pace of possible monetary tightening. China’s modern stock markets are only three d …

Read more

恭喜发财 Gōng xǐ fā cái

To our clients celebrating Lunar New Year, A very Happy New and Prosperous New Year to all of you and your loved ones in this Year of the Ox! From, the BlueRocke team.

Read more

2021: Three sustainable investing themes

By Jenn-Hui Tan Global Head of Stewardship and Sustainable Investing Sustainable investing identifies themes that will grow in importance based on our needs as human beings. We need a stable climate to survive and, to achieve that and thrive, we need a …

Read more

Video – Global Strategy Update January 2021

In this video, Hamish Douglass, the Chairman and CIO at Magellan, provides an update on recent performance, what the latest vaccine mutation could mean for markets, discusses Chinese stock Alibaba and outlines what he’s looking for in 2021. (Viewing ti …

Read more

Retirement – Fears and expectations

By Richard Dinham, Head of Client Solutions and Retirement, Fidelity International For many, the word ‘retirement’ is associated with the idea of extended holidays to far-flung locations or spending quality time with grandchildren. And while the new-fo …

Read more

Season’s Greetings

Dear All It has been a historic year with positives and not so positives – with Middle East peace accords, dropping oil prices, lowering loan interest rates, easing video conferencing, reducing infection rates, generous government subsidies and budget …

Read more

5 financial moves to make in your 50s and 60s

Once you hit your 50s and 60s, retirement is no longer something happening far off into the future. In fact, it’s at your doorstep. Now is the time to really figure out where you stand financially, reassess your long-term goals, and focus on planning y …

Read more

How to build wealth in your 30s

To all the thirty-somethings out there, now’s your time to shine! These are the years that will shape the rest of your life. If you’re looking for a bright future—that’s not held back by financial worry—here’s five simple tips to start building wealth …

Read more

The road ahead for global listed infrastructure after a difficult Covid landing

In this video, the Magellan GLOBAL Listed Infrastructure team lead byGerald Stack, Magellan’s Head of Investments & Infrastructure share their insights on the current state of the global listed infrastructure sector, including the recent performanc …

Read more

Well prepared for a long-retired life?

Retirement is a time of unemployment. So retiring at 65 while living to 95 (as many do), will mean living for 30 years in unemployment. Would your savings and super last that long? If you are unsure and would like to discuss this , please …

Read more

Podcast – Votes, vaccines, and a re-emerging world for investors

As a new and very different president-elect prepares to enter the White House, and as vaccine hopefuls emerge to suppress the devastating impact of COVID-19, what are the biggest risks and opportunities for investors in 2021 and beyond? In this podcas …

Read more

New SA COVID restrictions

Dear All In response to the COVID-19 advice and restrictions announced by the State Government, we will be working remotely for most part. Due to the high level of agility with our technologies, we will remain fully operational. Most of our meetings an …

Read more

10 Australian women share their number one money tip

A smart saving strategy is just one element of achieving financial security – you also need a deliberate plan to manage and make the most of what you have. Here, 10 money-savvy women share one tip that’s helped them get their finances into a healthier …

Read more

The crucial super moves you need to make today

Many women reach mid-life with a significant superannuation shortfall. But it’s not too late to turn things around. Actions now may help set up a more secure retirement. When was the last time you checked your super balance? The hard fact is that Austr …

Read more

Do you need a financial adviser?

Do we really need to pay a financial adviser to tell us to spend less, save more and invest more? Yes, for the same reason we (or Medicare) pay a doctor to tell us to eat healthier, exercise more and get adequate sleep. But there is another rea …

Read more

Are you, your own financial adviser?

We believe in providing wealth building strategies that would make our clients wealthier than they would be, on their own. This is the ‘value-add’ we provide. If you would like to enjoy these ‘value-add’ services, please email us on info@blueroc …

Read more

Want a Porsche at a reasonable price?

We offer a best-in-class private advisory service. But you won’t see the plush carpeting to go with it, as we keep our overheads low (we do have a barista though!). Lower overheads translate into lower costs for you. If you would l …

Read more

Head in a spin with all your financial questions?

We are best suited for those with complex wealth building needs: covering risk, investment portfolios, business entities, debt, gearing, estates, trusts, SMSFs etc. Clients with such ‘high touch and multiple needs’ sometimes are overwhelmed with …

Read more

Feeling abandoned by your financial institution?

Feeling unloved by your institution because your investment balances are too small? Come talk to us – we love all our clients. Please email us on info@bluerocke.com or ds@bluerocke.com with your contacts, for an exploratory meeting …

Read more

2020 Federal Budget – Summary & Video

Last night, the Government handed down the 2020 Federal Budget. Key proposals include: Tax cuts for low and middle income earners through bringing forward the ‘Stage 2’ tax relief, increasing the Low Income Tax Offset and retaining the Low and Middle I …

Read more

Is investing in bonds safe?

To no one’s surprise, there has been renewed interest in government bonds in recent months, considered safe havens during troubled times. While no investment is completely risk-free, in comparison to other investment options likes shares and property, …

Read more

Why super balances fluctuate

Should you worry if your super balance is fluctuating? Or is it a sign that you’ve got the right long-term, growth-oriented approach to your super…. The answer depends on whether your super choices are aligned to your needs. For many Australian super i …

Read more

Retirement: where to start

While many of us dream about the day we finally get to give up work and reap the benefits of our blood, sweat and tears, we often struggle to plan for it. After all, in the scuffle of immediate priorities, saving and planning for retirement don’t alway …

Read more

Guide to planning your estate 2020/21

Estate planning is about much more than preparing a Will. This comprehensive guide will help you get started with how to plan an individual’s end of life care and their assets if they should become incapacitated or die. Need advice? We’re here to help, …

Read more

Personal insurance concepts

New To Getting Personal Insurance? These 3 articles explain the different Personal insurance concepts: types of Insurance and potential uses how much cover do you need? ways to make life and TPD insurance more affordable Did you know? In a recent surve …

Read more

InReview: Perspectives on the future of the global economy (video)

Hamish Douglass, Magellan’s Chairman and Chief Investment Officer, spoke with Janet Yellen, the most recent former chair of the Federal Reserve, and an adviser to Magellan, about the covid-19 health and economic crisis. The pair discuss the response of …

Read more

Managing the COVID-19 crisis–an update on Government policies that might affect you

The ongoing Coronavirus crisis is all over the news and while the reports from Victoria are concerning, it’s good to remember that in absolute and global terms Australia is still managing the medical crisis exceptionally well. That said, the lockdowns, …

Read more

Four tips to get your super back on track

Like many Australians, you may have dipped into your super early as part of the government’s Coronavirus financial hardship scheme. While the extra funds can come in handy right now, it’s important to keep sight of the bigger picture. If you lost your …

Read more

Industry Insight by Bob Cunneen

Bob Cunneen, senior economist and portfolio specialist, MLC Asset Management This content is produced by The Australian Financial Review in commercial partnership with MLC. History is scarred with dramatic events that can shatter economies and politica …

Read more

Early access to super extended

On 23 July 2020, the Government released the Economic and Fiscal update which included previously announced measures that were amended or reconfirmed. Extension of early release of super (coronavirus) application period Access to superannuation for eli …

Read more

2019-20 financial year in review

The 2019-20 financial year was dominated by the COVID-19 pandemic After initially appearing as a health issue limited to a province in China, the virus responsible for causing the COVID-19 disease began to spread rapidly across international borders in …

Read more

Economic and market update video – 10 July 2020

Economic and market update video – 10 July 2020 Share markets up, but economic concerns remain: what’s going on? Markets have been buoyed by central bank and government support for economies. However, COVID-19 remains a threat and economies are still f …

Read more

End of year market update June 2020

What happened over the financial year? What is the Outlook? Scott Tully, General Manager, Investments Colonial First State shares his view on market trends and economic updates for the June 2020 quarter in this short 2 minute video. Source: Colonial F …

Read more

Tax treatment of COVID-19 support payments

For most Australians, this tax time will be unlike any other. If you’ve lost your job, had to work reduced hours due to COVID-19, or met other eligibility criteria, you may have received government assistance like JobKeeper, extra JobSeeker, or accesse …

Read more

Investment insights on the path ahead to a market recovery

While it seems financial markets have survived the first waves of volatility, what could happen next – and what might that look like? The Coronavirus impacted businesses, households and individuals worldwide, resulting in the shutdown of much of the wo …

Read more

Economic and market update video – 15 June 2020

Economic and market update video – 15 June 2020 Bob Cunneen, Senior Economist at MLC Asset Management, discusses the continuation of the May share markets rally in Australia and overseas in anticipation of a reopening of economies, despite COVID-19 inf …

Read more

How to manage debt during COVID-19

It’s easy to think you’ll never get ahead when you have mounting bills to pay, on a reduced or lost income and limited savings, all because of a pandemic that no one saw coming. But, it can be done. Take confidence in knowing that with determination, u …

Read more

HomeBuilder program announced

The Government has announced the HomeBuilder program to help drive economic activity across the residential construction sector by providing grants of $25,000 to eligible owner-occupiers for new home construction and substantial renovations. Read the f …

Read more

Extended lodgement time frame – Notice of Intent to claim a deduction in 2018/19

Extended lodgement time frame – Notice of Intent to claim a deduction in 2018/19 The ATO has written to an estimated 25,000 individuals who: have claimed a tax deduction for a personal super contribution in the 2018/19 financial year, and whose super f …

Read more

Contribution flexibility for older Australians – Regulations made

On 29 May 2020, the Government made regulations which increase the age at which contributions can be made: without meeting the work test, and on behalf of a spouse. The measures are effective from 1 July 2020. It is important to note that legislation w …

Read more

Coronavirus investment opportunities – what to look for in share markets

While share markets have experienced some of the sharpest falls in history, amid the Coronavirus pandemic, savvy investors have been looking out for opportunities created by recent events. Travel, tourism, retail and universities are among some of the …

Read more

Economic and market update video – May 2020

Economic and market update video – May 2020 The coronavirus has had a significant impact on investment markets. Bob Cunneen, Senior Economist at MLC, discusses what to expect over the coming months in this 5 minutes video. Source: https://www.mlc.com.a …

Read more

The purpose of good financial advice in a crisis

The purpose of good financial advice in a crisis In this 3 minute video, MLC’s Brendan Johnson discusses the role of good financial advice during COVID-19 and how clients want to build confidence and a sense of control in this extraordinary time. We ar …

Read more

Economic and market update video – April 2020

Economic and market update video – April 2020 The coronavirus has had a significant impact on investment markets. Bob Cunneen, Senior Economist at MLC, discusses what to expect over the coming months in this 5 minutes video. Source: https://www.mlc.com …

Read more

Global Financial Crisis in 2008 again?

Are current market events a repeat of the Global Financial Crisis in 2008? Current market volatility is distinctly different to the GFC. For one, banks will be part of the solution this time, not the problem. Portfolio Manager, Myooran Mahalingam discu …

Read more

Managing your super in a market downturn

We’re here to help you understand what happens in a share market downturn, If you’ve seen a decrease to your super balance as a result of the coronavirus, it’s understandably cause for concern. When your balance goes down (or up), it’s as a result of c …

Read more

Covid-19 and your super

Important Update – The Government’s new super and pension provisions announced 22 March Over the weekend, the Australian Government announced its economic support package to help Australians who are under financial stress as a result of the Coronavirus …

Read more

Economic and market update video – March 2020

Economic and market update video – March 2020 The coronavirus has had a significant impact on investment markets. Bob Cunneen, Senior Economist at MLC, discusses what to expect over the coming months in this 5 minutes video. Source: https://www.mlc.com …

Read more

Changes to income protection insurance

What is income protection? Also known as ‘salary continuance insurance’ or ‘disability income insurance’, income protection provides a portion of your income, for example 75% of your annual salary, if you are unable to work due to injury or sickness fo …

Read more

Small steps to great success

If you want to get ahead, financially, it’s necessary to take some steps to get there. It may seem daunting and overwhelming but like anything, if you have a professional guiding you along the way, small steps can lead to something great. Step 1 | Seek …

Read more

Do you have more than one super account?

Did you know there is over 10[1] million Australians with a superannuation account, approximately 36% of which hold more super accounts, which make up $20.8[2] billion in ‘lost super’. Is some of that yours? Find it Moved house? Changed jobs? Don’t kn …

Read more

New Year, New Job – What’s your resolutions?

New year is a great time for making lifestyle changes, however, for resolutions affecting your financial health, there’s often no better time than when starting a new job.

Read more

Season Greetings

Wishing all our clients a joyous holiday season and a New Year filled with prosperity, success and happiness!

Read more

How to manage finances in a relationship

Couples can reach their shared goals by keeping their finances healthy. Here are some tips on managing finances with your partner. If you would like to enquire about whether BlueRocke can be of help to you, please click here.

Read more

Money Mistakes

Nobody likes making mistakes, especially when there’s money on the line. Avoid expensive mistakes. Make the right decision for your financial future today. Contact Dev Sarker on 1300 717 136!

Read more

Break free from being asset rich and cash poor

Here are four ways to try boost your income. Are you asset rich but cash poor? You’re not alone. Data from the Australian Bureau of Statistics shows that almost one-third of older Australians in low-income households were asset rich but cash poor.[1] M …

Read more

Protecting Your Small Business

Owning and operating a small business is hard work. The last thing you need is to lose it all because of poor insurance choices. Do your homework First you need to work out what needs to be covered. There are the obvious things such as plant and equipm …

Read more

The Power of Regular Investing

Want to invest your money but not sure where to start? Get in contact with Dev Sarker today on 1300 71 71 36!

Read more

How do your gift giving habits compare?

Source: moneyandlife.com.au Have you ever thought about how much you spend on gifts throughout the year? Did you know Australians spend nearly $20 billion a year on gifts? That’s about $1,200 each per year or $100 a month. New research* reveals other t …

Read more

Five tips for looking after your large household’s finances

Take the pain out of managing your family’s finances. Taking care of household finances can be taxing, especially if you have a big family. But with proper planning and budgeting, there’s no need to stress. Here are some tips to help you effectively ma …

Read more

Four ways social media affects our spending

Social media could influence us to spend impulsively. Can social media use be linked to spending? Research shows it can. For example, one study found that social networks such as Facebook and Instagram can motivate impulsive buying behaviours.[1 …

Read more

Putting your goals first

A goals-based investment approach isn’t focused on ‘beating the market’. It’s about tailoring your investments to meet your personal goals. Your adviser may help you create a financial plan tailored to help you achieve the goals you want. Get in contac …

Read more

Cash flow can make or break your business, so take time to safeguard it

According to a recent survey by research firm East & Partners for lender Scottish Pacific, nearly 80 per cent of owners of small and medium enterprises said cash flow issues caused them the most sleepless nights.[1] So what might you do to improve …

Read more

Successful Investor Secrets

The investment world can change dramatically from one month to the next. But these secrets of successful investors never go out of style. Successful investing can be one of your biggest allies in the quest for long-term financial security. Unfortunatel …

Read more

Prune, adapt and budget: Managing the rising cost of living

If you’re organised with your finances, the high cost of living doesn’t have to mean diminished savings. The increasing cost of goods and services – from food and housing to transport and utilities – is a reality most Australians have to face every day …

Read more

Four ways to teach children healthy money habits

Set a good example for your children with just a few simple changes. As a parent, you try to ensure your children have the skills to make smart financial decisions. For example, you tell them about the importance of saving or the power of compounding i …

Read more

Here’s why you need income protection

Your ability to earn an income is usually one of your biggest assets, so why not protect it? A sudden illness or injury can keep you from working and leave you in financial difficulty. You may get help from a worker’s compensation payout or personal sa …

Read more

Five financial moves to make in your 40s

In your 40s? Here’s what you need to consider to financially get ahead. Being in your 40s often involves balancing many responsibilities that it becomes easy to neglect your own financial wellbeing. But it’s not too late to secure your future. Here are …

Read more

Superannuation: Too important to ignore

Superannuation is the one thing you could do for your financial future this year, that could make a big difference to your retirement income. But how much do you really need? That’s a big question. As we know, everyone’s needs are different, unexpected …

Read more

Stay financially healthy even in sickness

Don’t let an illness stop you from looking after your finances. A Financial Adviser could work with you to develop a financial plan that’s specifically tailored to your needs, so get in touch with Dev Sarker today on 1300 71 71 36.

Read more

Insurance: Get insurance while you’re still bulletproof

According to research by TAL insurance provider the cost of personal insurance soars after the age of 35. This is also the time in our lives that you may be going through significant change such as marriage, children, a bigger mortgage and more respons …

Read more

Cashflow: Keeping top tips top of mind

We all like a good cost saving tip, even if it is something we already know, it never hurts to revisit some top tips and take a look at our current situation to see if there are savings to be made. Any little savings we make throughout the year can be …

Read more

Take control of your retirement

Are you planning to retiring in the next 5 years? Are you affected by the increase in the Age Pension’s qualifying age? Take steps now to avoid getting caught short on retirement income. The minimum age to qualify for the Age Pension has started going …

Read more

Five ways to stick to your financial resolutions

Setting a financial goal for the New Year? Take steps to make it work. It’s that time of year when we set new goals or dust off old ones. But how can we boost our chances of sticking to our financial resolution? Here are some practical tips. 1. Choose …

Read more

Season’s Greetings

As we approach the end of another year, we would like to wish you all the best for the festive season, and the year ahead. From all of us at BlueRocke!

Read more

Boost your super with the work test exemption

If you’re a recent retiree and looking to increase your superannuation savings, here’s some good news for you. The Australian Government is proposing to make it easier for recent retirees to save more super by allowing them to contribute for a year wit …

Read more

Save through super for your first home

A new scheme may help you make your dream of owning a home come true. High property prices have made owning a home unattainable for many prospective first time buyers. But the First Home Super Saver scheme, passed by the Australian Government in Decemb …

Read more

Be retirement ready – plan early

You need to be savvy to build a sufficient nest egg for retirement. Planning is key, and so is getting professional advice. Most Australians are not saving enough for retirement and risk running out of money sooner than they expect. Data shows that in …

Read more

Staying on top of finances for a small business

There is a lot to keep track of when running a small business, including your finances. They can make or break your business, so here are some pointers to help you keep them in check. Don’t lose out Ensure you are taking advantage of recent tax and reg …

Read more

Get help choosing personal insurance

When things go wrong, it’s nice to know you’re covered. But getting suitable insurance cover can be a matter of getting professional advice. Protecting what you have worked hard for is important, so it’s essential to get appropriate insurance cover. To …

Read more

Take a break – without breaking the bank

Holidays should be a well-deserved break from worry. Here’s how to minimise your stress and have a relaxing time away. Plan ahead Doing your research may be one of the best ways to save money on your holiday. Even with the summer holidays just around t …

Read more

Financial literacy leads to healthy habits

It’s an important skill but many people are still not as financially literate as they should be. Here are some ways that may help you improve. Financial well-being is defined1 as when a person is able to meet expenses and has some money left over, is i …

Read more

Five things to consider when giving to charities

The urge to donate is strong in Australia, and it’s easy to make it part of your financial plan. An estimated 14.9 million Australian adults (80.8 per cent of the population) gave $12.5 billion to charities and not-for-profit organisations in 2015–16. …

Read more

SMSF jargon buster!

A quick guide to some technical SMSF terms Self-managed super funds (SMSFs) have become extremely popular in Australia, with more than half a million SMSFs now in existence, and they’re still growing.* You probably already know that superannuation term …

Read more

Self-Managed Super Funds: A Quick Guide

A self-managed super fund (SMSF) allows up to four people to pool their super and take full control and responsibility for managing it as trustees. The sole purpose of the SMSF is to provide benefits to its members on their retirement. Super popular! T …

Read more

Navigating your SMSF route

SMSFs – What you can and can’t invest in SMSFs have become very popular, with more than one million members now representing the fastest growing segment of Australia’s superannuation market.* The main reason for the popularity of SMSFs is the unrivalle …

Read more

Insurance and your SMSF

Insurance and your SMSF You can purchase insurance within your SMSF, and more importantly, the super laws require trustees to consider the insurance needs of members when draing and reviewing the fund’s investment strategy. Considering the insurance n …

Read more

Recent changes to super: are you affected?

You may be aware of the proposed superannuation changes that the Government announced in the May 2016 Federal Budget. Last Thursday, Treasurer Scott Morrison advised that some of these proposed measures have changed. This article will go some way to pr …

Read more

Financial Strategy for the New Year

As the new financial year has just begun, it’s a good time to consider your financial strategy for the rest of the year. Important actions to consider Salary sacrificing into super, while saving on tax, can help you build for retirement If you receive …

Read more

Handling your spouses’ super

Options to consider when handling your spouses’ super when they pass away You can choose to take your spouse’s superannuation death benefit as a lump sum, a pension or a combination of both A lump sum can allow you to pay off debts, whereas a pension p …

Read more

Sequencing Risk

How financial market volatility affects investors at different life stages Many people understand that volatility in financial markets can affect the value of their investments. Taking a closer look at sequencing risk, we will explain how the order of …

Read more

Negative gearing

How does it work and is it a good strategy for you? The recent housing boom in Australia has been driven by both investors and home-buyers. According to the Australian Bureau of Statistics, investment loans hit record levels in June 2015, contributing …

Read more

Investing an inheritance? Consider this…

If you have just received an inheritance, you may be considering different ways to best make use of it. The different choices you have to use and invest this money may seem endless: take a holiday, put it towards your children’s education, pay off your …

Read more

Accessing Your Super Savings

You’ve worked hard, diligently building up your super balance and you’re looking forward to retiring early. To reach that milestone, you will need to understand when you can start drawing from your super. The Australian government puts age and other re …

Read more

Benefits of Contributing to Super

It may be easy to forget the 9.5% that is automatically paid by your employer into your super fund every pay check. However, it’s your money and will play an important role in your financial future. Your super should be one of the biggest assets you ac …

Read more

Hindsight Bias

Introduction After an event has occurred, people often look back and convince themselves that the outcome was obvious and likely, and that they could have predicted it. This is known as ‘hindsight bias’, or the ‘knew-it-all-along’ effect. In actual fac …

Read more

The Power of Compounding

Compounding isn’t a new concept – many of us will remember studying it back in our school days. Legendary scientist Albert Einstein famously called it ‘the most powerful force in the universe’, while American business magnate John D Rockefeller suggest …

Read more

Herd behaviour

Herd behaviour is driven by emotional rather than rational behaviour. Often little attention is paid to investment fundamentals as investors focus on what other people are reacting to in the market. All investors are prone to behaviours and emotions th …

Read more

Cashed Up

When cash is king, choose the best option for you. Hoarding your dollars under the mattress probably won’t have much appeal for many of us. But is it possible you may be doing the modern day equivalent with your current cash investments. The reason the …

Read more

Passive Vs Active Investing

Thoughtful people who are long-term investors must first decide on their investment objectives when deciding between active or passive managed funds. Investing in equities is an increasingly popular method of assisting people to achieve their long-term …

Read more

Ethical Investing

Ethical investing involves much more than most people realize. It can offer numerous opportunities and benefits for individual investors and those preparing for retirement. So then, what does it mean to invest ethically? The basics investment process …

Read more

Investment Mix

Bonds, property, cash or shares? Choosing an investment mix A little knowledge can go a long way when determining which investments are appropriate for your tolerance to risk, investment goals, timeframe and circumstances. It is therefore important to …

Read more

What To Do With A Windfall

Four tips on what to do with a windfall If you were lucky enough to land a windfall, before you rush off on that long dreamed of holiday, here are four practical considerations: Reduce your debt The most financially sensible thing you could do, is pay …

Read more

Mortgage Paid?

Mortgage paid? Save for the future Now that you’ve paid your mortgage off, here are three ways to start thinking about building wealth for tomorrow: Invest regularly in managed funds Paying off a mortgage teaches you the healthy financial habit of sav …

Read more

Get The Right Advice

It’s never too late to get the right advice Receiving financial advice from an expert could change your life and give you the peace of mind only a well-constructed plan can bring. A financial adviser may assist in maximising your retirement income and …

Read more

Prospect theory

Prospect theory suggests that humans are non-rational decision-makers, and that losses carry a greater emotional impact than gains. It also explains a key reason for inertia in investment decision-making. Prospect theory is an explanation of human deci …

Read more

The disposition effect

The disposition effect All investors are prone to behaviours and emotions that can lead to poor investment decisions. One of the most common of these is the tendency to sell investments that have risen in value, and hold on to investments that have fal …

Read more