Herd behaviour is driven by emotional rather than rational behaviour. Often little attention is paid to investment fundamentals as investors focus on what other people are reacting to in the market.

All investors are prone to behaviours and emotions that can lead to poor investment decisions. One of the most common pitfalls is known as ‘herd behaviour’. This describes large numbers of individuals acting in the same way at the same time, typically by buying into rising markets and selling out of falling markets. This behaviour can cause markets to dramatically rise and fall in value – known as ‘bubbles’.

Bubbles can only be identified with hindsight, after a rapid and marked drop in value has occurred. These sudden drops are sometimes referred to as ‘crashes’ or ‘bubble bursts’. Because bubbles are only identified in retrospect, many investors often get caught out by the sudden and rapid decline in the value of their investment.

Herd behaviour is driven by emotional rather than rational behaviour. These emotions are typically optimism and greed when markets are rising, and fear and panic when markets are falling. Little attention is paid to the investment fundamentals, which means herd behaviour rarely leads to successful investment outcomes.

There are two main drivers of herd behaviour when it comes to investing. Firstly, people don’t want to miss out on making a profit. Secondly, we assume that when a large number of people are buying into the same investment, they can’t all be wrong. This means that there is often little understanding of the underlying investment, and more attention is focused on what other people are doing. Consequently, it is often the less experienced investor who gets caught up in herd behaviour.

Bubble indicators – what to watch out for

- Strong, sustained rallies and stretched valuations

- Hearing ‘this time it’s different’

- A flurry of initial public offerings, mergers and acquisitions

- Investor greed and a fear of missing out

- Everything moving together, regardless of quality

- Media headlines talking up the latest investment trend

Case study

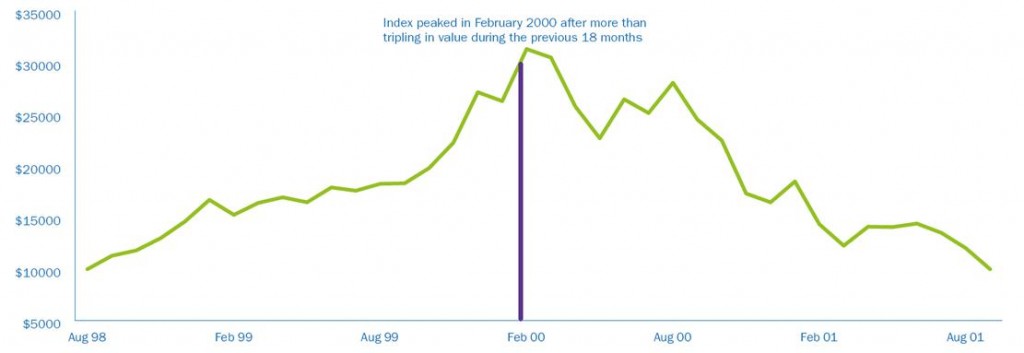

It’s October 1999 and Ken has been keeping an eye on the sharemarket. Everyone is talking about the exciting future of technology companies and he has noticed most of them have doubled in value during the past 12 months. He doesn’t know much about investing or technology companies, but assumes all the other investors know something that he doesn’t. Without really understanding why the stocks are rising, he invests $10,000 in a technology-based index fund, reassured that many other investors are doing the same. Four months later he is delighted that the value of his investment has risen more than 50%. All those people were right after all.

Then, in February 2000, his investment starts losing value and Ken can’t see any reason behind the fall. All of a sudden everyone is rushing to sell their technology stocks and no one is buying any; the exact opposite of just a few weeks earlier. The drop in value is so abrupt that by the time Ken reacts and sells his holdings he has lost most of his original investment.

Like many others who had jumped on the ‘dot.com’ bandwagon, Ken did not do his research and invested without fully understanding the sector or risks. He thought to himself “this time it’s different”. Looking back he acknowledges that the signs of a bubble were there for all to see.

One way to avoid such a pitfall is to invest in a well diversified investment portfolio with a disciplined investment process which is designed to meet long-term investment goals, rather than be concerned with following the latest trend.

Exhibit 1: Value of $10,000 invested in the technology-based NASDAQ stock market (three years to 31 August 2001)

Source: Bloomberg. Chart is used for illustrative purposes only.

While it’s tempting to follow the latest investment trend, it is imperative to always fully understand an investment before making an investment decision.

Feel free to contact me if you have any questions about herd behaviour.

“Be greedy when others are fearful and fearful when others are greedy” – Warren Buffet