A new scheme may help you make your dream of owning a home come true.

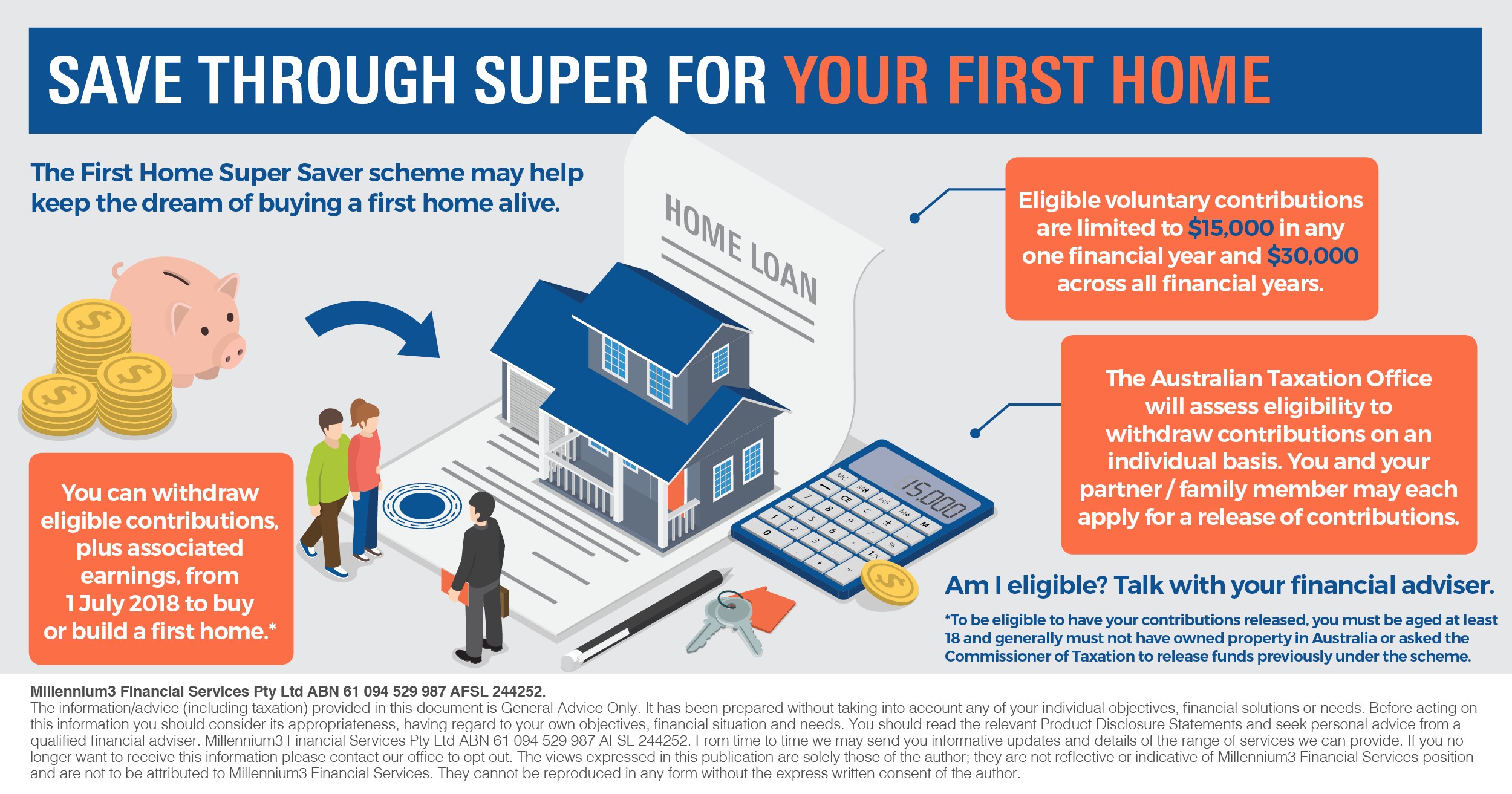

High property prices have made owning a home unattainable for many prospective first time buyers. But the First Home Super Saver scheme, passed by the Australian Government in December 2017, may help keep their dream of buying their first home alive.

The scheme helps you save for your first home by allowing you to use the concessionally taxed superannuation environment to build a house deposit. Eligible voluntary contributions are limited to $15,000 in any one financial year and $30,000 across all financial years. They include voluntary concessional and voluntary non-concessional contributions.

You can withdraw eligible contributions, plus associated earnings, from 1 July 2018 to buy or build a first home. You may be allowed to withdraw 100 per cent of eligible non-concessional contributions and 85 per cent of eligible concessional contributions.

Check if you’re eligible

To be eligible to have your contributions released, you must be aged at least 18 and must not have owned property in Australia or asked the Commissioner of Taxation to release funds previously under the scheme. If you have owned property, you may still qualify if the Commissioner determines that you have suffered a financial difficulty that led to the loss of your property.

The Australian Taxation Office will assess eligibility to withdraw contributions on an individual basis. This means you and your partner or a family member may each apply for a release of contributions to buy the same property.

Once your super fund releases your contributions, the Commissioner of Taxation will withhold tax. This will be calculated at your marginal tax rate – less a 30 per cent offset.

You have up to 12 months from the time you receive the first amount to sign a contract to buy or build a house. If you need more time, you may apply for an extension of up to 12 months.

Get advice

It’s important to seek professional advice before you consider making or withdrawing voluntary super contributions to buy your first home.

Contact Dev Sarker on 1300 71 71 36 today to see how the scheme can work for you!