While share markets have experienced some of the sharpest falls in history, amid the Coronavirus pandemic, savvy investors have been looking out for opportunities created by recent events.

Travel, tourism, retail and universities are among some of the hardest hit sectors in Australia, due to Coronavirus.1 On the flip side, pharmaceuticals, video conferencing, entertainment streaming and e-commerce marketplaces have been coming out on top.2

So, if you’re looking for investment opportunities for long-term returns, here are five principles that may help you get started. But keep in mind, share markets are unpredictable, even when things seem to be improving they can turn very quickly.

1. Keep a long-term perspective

When making changes to your investment portfolio, it’s important to have a long-term view and plan to have your money invested for a while.

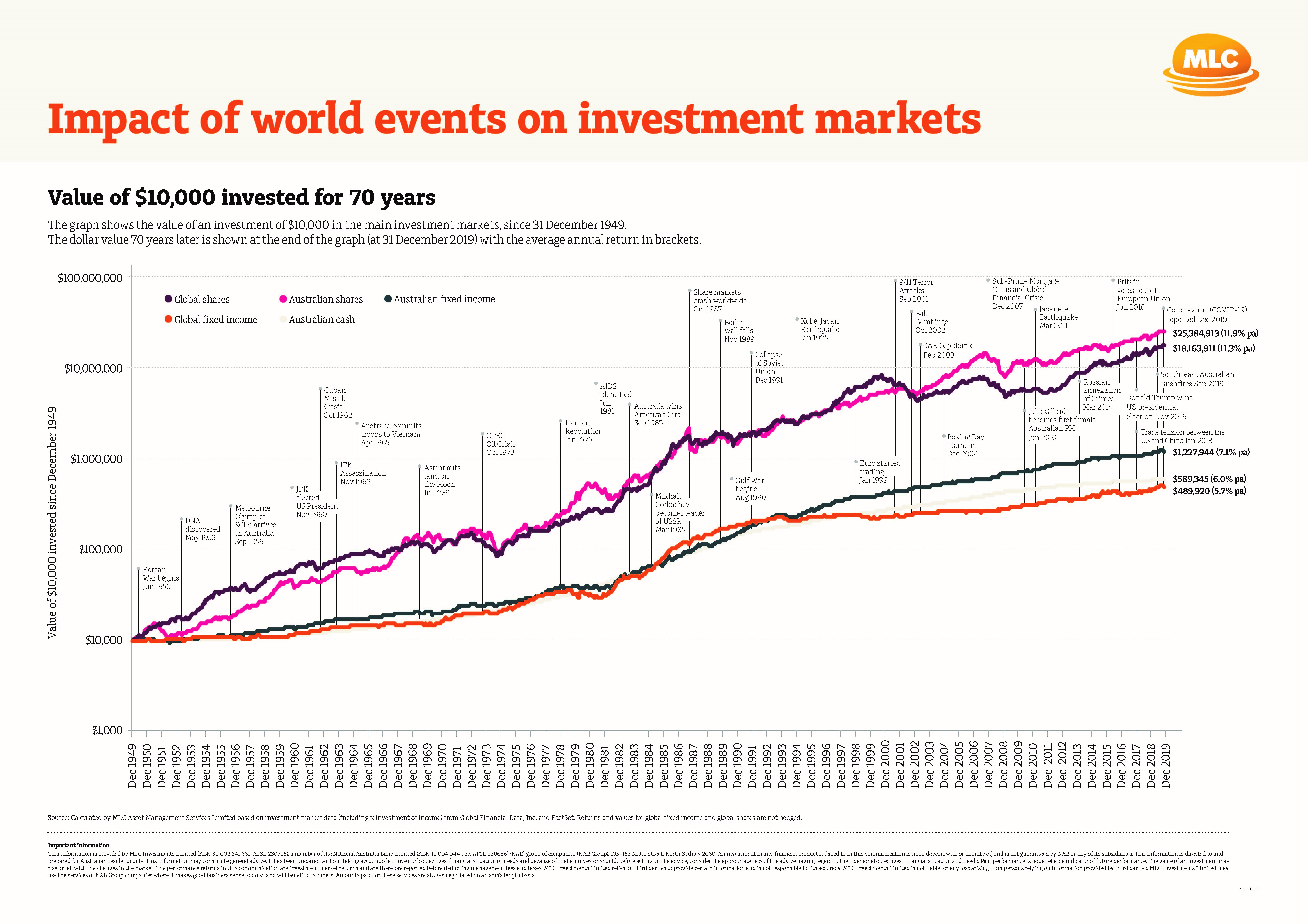

Just as we’ve seen a decline in share markets recently, historically it has recovered. From the 1987 Stock Market Crash to the bursting of the Tech Bubble in 2000, each trigger is different and the time it takes to recover varies too. It could take months or even years.

As such, if you do decide to make changes to your investments during the current volatile markets, it’s important to remember that the future is uncertain. Markets are constantly revaluing company prices with new information so this volatility is likely to remain until there’s certainty around the containment of Coronavirus.

2. Do your research

There’s a lot of ‘noise’ about the current state of the market, so keeping informed and getting an in-depth understanding about where you’re investing, is key.

Here are just a few of the things you could consider when looking at listed companies in the share market.

- Does the company have a good track record?

- Where does it get its earnings from, domestically or internationally?

- How much debt does it have and when is it up for renewal?

- How are the company’s earnings going to be affected by Coronavirus?

- Does the business have a strong competitive advantage?

- Does it have stable revenue and income?

- What are its risks in different economic environments?

- What price would you be prepared to pay for shares in the company?

- What are the risks specific to this company, its industry, and share market more generally?

If you decide to purchase shares in a company, consider monitoring it and any share market announcements, including financial updates or results, issues affecting the industry and any competitors.

You may also want to keep an eye out for any news coverage and interviews about the business to get a feel for their current and long-term viability.

And that’s just the beginning. You need to consider how you’ll reduce your exposure to the risks of investing in that company. Most people manage that risk by investing in many companies and asset classes because their performance is influenced by different factors.

3. Look for the red flags

It’s important to distinguish between companies who have seen their share price fall as a result of market panic, caused by events like Coronavirus, and those that have fallen because they were already unstable and their weaknesses have been revealed by the economic downturn.

When identifying these undervalued shares, consider how much Coronavirus will impact the company now and in the future. It’s also important to look at the company’s balance sheet and business model to see if it can withstand this pandemic, or if it’s prospects are substantially compromised by a further drop in share markets.

Other red flags to look out for include companies with a significant amount of debt or those that may be highly affected by economic conditions.

You may also want to check the company’s position regarding ethical and sustainable investing and whether it aligns to your own values.

4. Consider contributing regularly

One of the ways to take advantage of a market downturn is to contribute a fixed amount to your investment portfolio on a regular basis.

The main benefit of this, as opposed to making a lump sum payment, is that it can help to reduce the impact of market volatility.

If you’re contributing the same amount of money as you were when markets were performing well, then when markets fall, you’re effectively purchasing at lower prices. For long-term investors, this is a great way of taking the guess work out of timing when to invest. Reality is, no one knows the best time to invest.

5. Seek support from professionals

Investment manager

You may not have the time or resources to do the analysis required to identify quality long-term investments so investing with a professional investment manager is an alternative option.

These companies have teams of experienced investment professionals doing the hard work for you and you pay them a fee for it. It’s important to consider if you’re comfortable with their investment approach and how they manage risk versus return.

Financial adviser

Obtaining independent advice from a financial adviser, before making any decisions, can help you design a plan to achieve your own financial goals. It may also provide you with a better understanding about the risks and rewards of investing and appropriate investments for you.

Bottom line: share markets are unpredictable so remember keep a long-term perspective. Given the complexities of investment decisions, it’s important to stay informed and seek support from professionals.

Source: https://www.mlc.com.au/personal/blog/2020/05/coronavirus_investme