Take the pain out of managing your family’s finances.

Taking care of household finances can be taxing, especially if you have a big family. But with proper planning and budgeting, there’s no need to stress.

Here are some tips to help you effectively manage your household finances.

1. Examine your finances

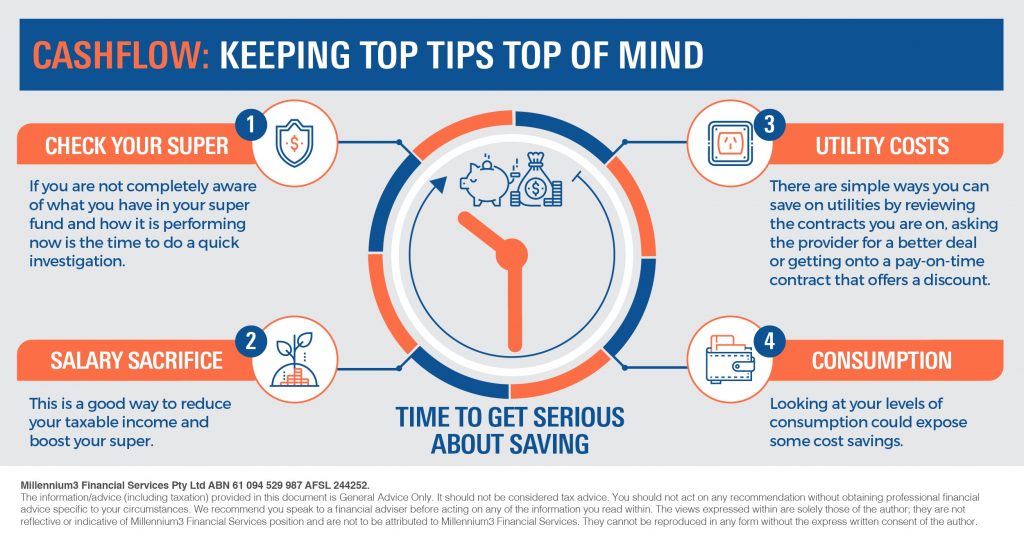

Sitting down as a family and figuring out how much money is coming in and going out may help you gauge the state of your family’s finances. A clear picture of your household income and expenses could set you up to manage your cashflow better.

2. Rein in spending

Keeping expenses under control can be tough in a large household. But if you’re spending as much as or more than you’re earning, you might want to consider limiting your family’s discretionary costs by buying only what you can afford.

3. Set financial goals

Setting financial goals as a family may help you work towards future aspirations instead of simply meeting current expenses. Whether it’s buying a bigger house or going on a dream holiday, having a financial goal may help your family set priorities and stay on track financially.

4. Keep a budget

Keeping track of spending may help you to better manage your family’s finances. By working with a professional financial adviser, you could create a budget that factors in not only income and expenses, but also your financial obligations.

5. Build up emergency and retirement funds

Unplanned expenses such as unforeseen medical bills can put a dent in family finances. By growing your emergency fund to cover six months’ worth of expenses, you may be better positioned to handle unexpected events.

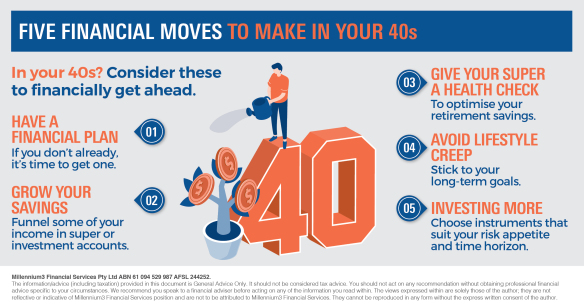

While it’s easy to neglect your own financial future when providing for your family, saving for retirement should not take second place. Keep in mind that the earlier you start saving, the better chance you have to grow a sufficient nest egg.

Working with an adviser

Managing finances for a big family need not be a painful exercise. By working alongside a financial adviser to keep track of your spending, and discussing money matters and setting financial goals as a family, handling household finances is a task you can achieve.

Contact BlueRocke on 1 300 71 71 36 today.