Should you worry if your super balance is fluctuating? Or is it a sign that you’ve got the right long-term, growth-oriented approach to your super….

The answer depends on whether your super choices are aligned to your needs.

For many Australian super investors—and there are 16 million1 of us—COVID-19 may have caused your super balance to change overnight.

In this article we’ll address the reasons for this and what it means over the short and long-term.

The COVID-19 crash

Your 2020 super balance has bounced around because COVID-19 has forced lockdowns around the world.

As the world’s economy largely depends on people getting together – in shopping centres, offices, stadiums, bars and airports—countries grounded to a halt. As the crisis began to unfold in Wuhan, Lombardy, London, New York and Auckland – share prices tumbled too.

Impact depends on how your money’s invested

In 2020 super balances haven’t just fluctuated downwards. As Governments and central banks flung masses of cash at the problem (and a clearer picture of the virus’ weaknesses emerged), share prices soared back up. The US and German markets both had an increase of over 20% in the June quarter.

So, what do all these numbers tell us about the nature of your super balance?

Growth fund

It will fluctuate. And it will fluctuate in proportion to the percentage of growth assets in your super fund options. If you’re in a Growth2 fund where perhaps 85% of your money is in shares and property, short-term falls in the sharemarket will be reflected in your super balance.

Balanced fund

The same is true—but to a lesser extent—if you’re in a balanced fund where you could have up to 70% of your money invested in shares and property.

Conservative

If you’re in Conservative or Cash options, your balance won’t move so much with the market as most of your capital is invested in low-return, low-risk options like cash and short-term government securities.

Higher returns mean more movement

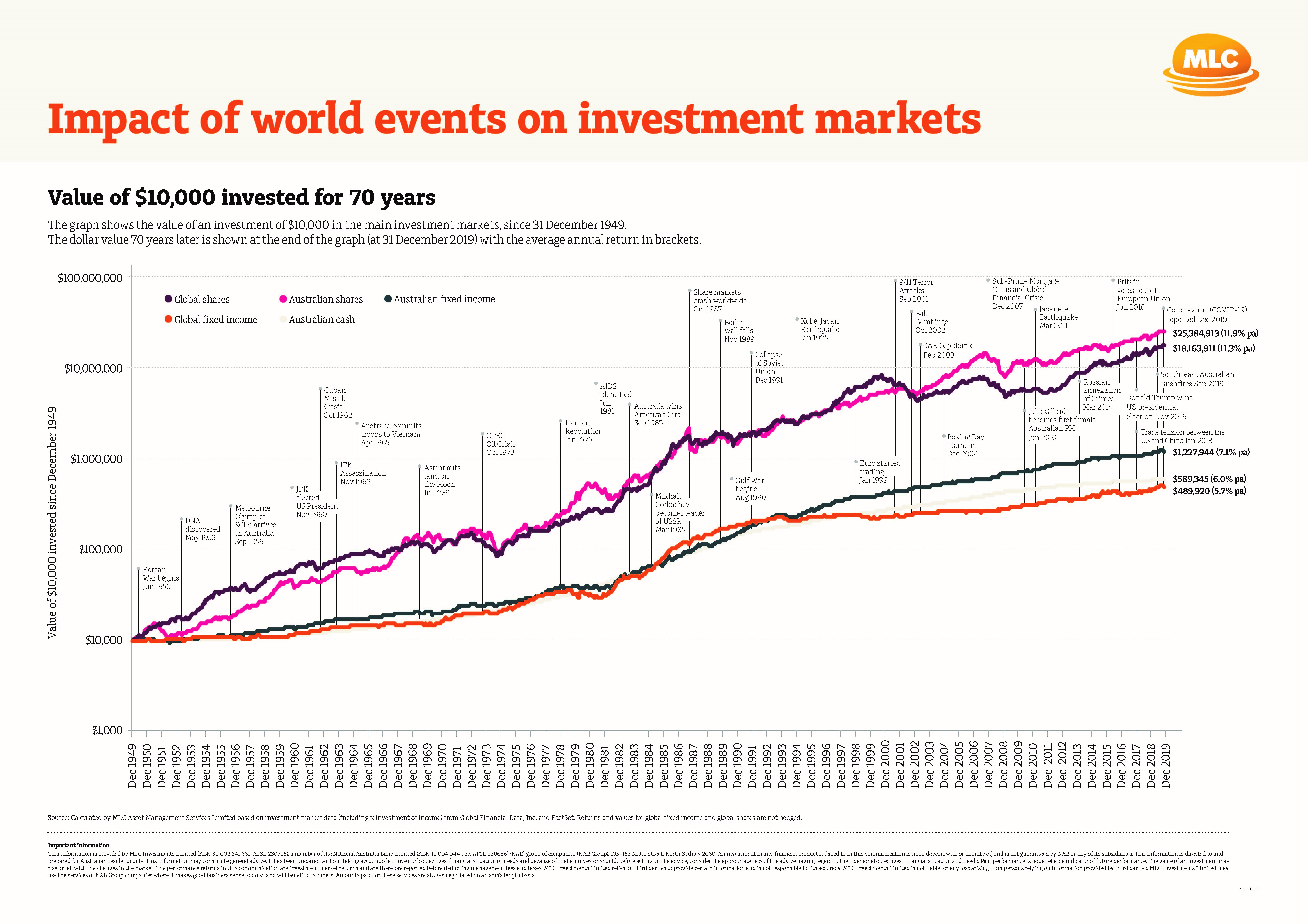

The crucial point is that this movement—the volatility—is the price you pay for higher returns.

In fact, over 10 years, the average person invested in a Growth super fund outperformed those invested in a Conservative super fund by more than 2% per year3.

That may not sound much, but super is a long-term investment and two percent extra a year, compounding over decades, can make a serious difference to the amount of money you retire on.

Determining your comfort level with volatility

Every person’s super plan is different.

If you’ve got a long time till retirement and you can look past short-term changes in your super balance, you may find that taking a more aggressive approach with your investment options is ok. This means your portfolio would have greater exposure to higher risk assets like shares and property than those with lower risk, cash and fixed income.

As you get closer to retirement, or if your super is all you have to rely on in retirement, a more stable super balance could be desirable so more conservative investment options may suit you.

Take control of your super

The best thing you can do is review your investment options and make sure they’re tuned to suit your age, attitude to risk, current financial circumstances and long-term plans. Speaking with a financial adviser might make that review even more effective.

At BlueRocke, our goal is to make you wealthier than you can be on your own. With appropriate advices, you may have a potentially improved financial position over time. Contact Dev Sarker at 1300 717 136 today!

1 ASFA: The benefits of Australia’s compulsory superannuation system – June 2020

2 We’re using categories from Moneysmart.gov.au. The exact numbers may differ slightly depending on the investment manager you’re with. The principles remain the same.

3 Chant West: Super funds navigate crisis to deliver surprise result – 17 July 2020

Source: https://www.mlc.com.au/personal/blog/2020/09/why_super_balances_fluctuate